Understanding the Different Types of Mortgages

A Guide for Buyers

If you're shopping for a new home, you should also be shopping around for the best mortgage that fits your lifestyle and needs. There are many things to consider when choosing a mortgage, such as how long you plan to live in the home. Is this your forever home, or is it just a temporary layover? Maybe you'll need to relocate for your job in a few years, or you plan to move closer to family. And while it may not seem all that important, it can make a big difference when it comes to deciding on the type of mortgage loan you need.

Conventional vs Government-Backed

Let's start with the basics: conventional vs government-backed loans. Conventional loans are financed by banks and other financial institutions and are not backed by any type of government support. These types of loans are geared toward buyers with higher credit ratings, higher and more stable incomes, and good debt-to-income ratios. Conventional loans typically require 20% down, but can be as low as 3%.

Government-backed mortgages, on the other hand, are geared toward helping buyers with lower credit scores, lower and less stable incomes, and higher debt-to-income ratios. These types of loans typically require anywhere from zero to 3.5% down. This low-to-no down payment option makes government-backed loans very desirable, but buyers need to beware that the costs are tacked on in other ways. For instance, buyers using government-backed loans will generally have added closing costs added on to the loan total. And, they will also pay PMI (private mortgage insurance). PMI is insurance for the lender, not the buyer; it serves as added protection in case the buyer fails to pay back the loan, and it can cost the buyer an additional $30 - $70 per month. The PMI will remain on the loan until the buyer has paid it down to a loan-to-value ratio of 80%, or the home equity has reached 20%. If this goal has not been reached by the halfway point of the loan term, it will drop off once the 50% mark (eg, 15 years into a 30-year loan). PMI ends up costing a buyer a lot of extra money. Now, don't get me wrong. I think government-backed loans are great. In fact, my husband and I took out a government-backed loan when we bought our house 13 years ago. However, we refinanced to a conventional loan 1 year later, so this is always an option as long as you are financially secure.

Okay, now that you have a little better understanding of conventional vs government-backed loans, let's take a look at the most common types of loans you will hear about when shopping for a home.

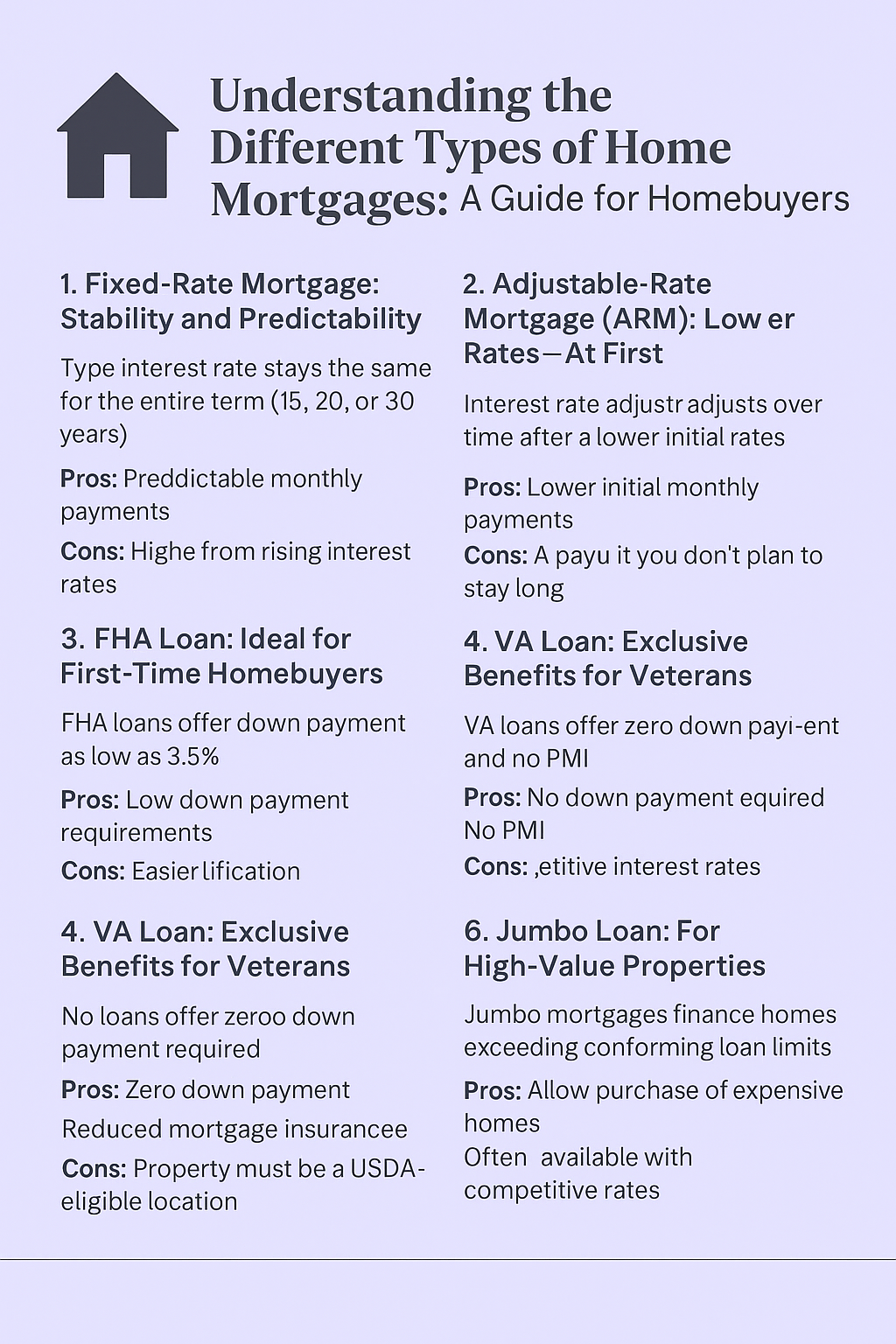

Fixed-Rate Mortgage

A fixed-rate mortgage is the most traditional and widely used type of home loan. With this loan, your interest rate stays the same for the entire term, typically 15, 20, or 30 years. One of the biggest pros to fixed-rate mortgages is the predictable monthly payments. You are protected from rising interest rates, but keep in mind this also means that if interest rates fall, you will still be paying the higher rate you are locked into. Of course, you always have the option to refinance with the lower rates. Fixed-rate mortgages are best for buyers who plan to stay in their new home long-term.

Adjustable-Rate Mortgage (ARM)

An adjustable-rate mortgage, or ARM, typically has a lower initial interest rate. It then adjusts after a set period (like 3,5, 7, or 10 years). The rate will rise or fall based on market conditions. ARMs are a great option if you don’t plan to stay in the home long-term, or if you plan to refinance within a few years.

FHA Loan

FHA loans are backed by the Federal Housing Administration and are designed for first-time buyers and those with lower credit scores. Down payments can be as low as 3.5%, and depending on the loan type, can even be zero down. FHA loans are a great entry point into homeownership. And the biggest pro, of course, is the low down payment. The biggest con, however, is the PMI. But, if your credit score is less than stellar and your income is on the lower side, FHA loans are the way to go.

VA Loan

A VA loan is available to eligible veterans, active-duty service members, and some military spouses. The Department of Veterans Affairs backs these loans, and they offer no down payment as well as no PMI. VA loans usually offer very competitive interest rates, and have no downside other than a one-time VA funding fee. Overall, this is a great option for eligible veterans, active-duty service members, and eligible military spouses.

USDA Loan

USDA loans are backed by the U.S. Department of Agriculture and help low-to-moderate income buyers purchase homes in eligible rural and suburban areas. USDA loans do not require any down payment. While they do not have PMI, they do have similar added mortgage insurance, though the cost is typically lower than the traditional PMI. Keep in mind, the property must be in a USDA-eligible location. Therefore, USDA loans are best suited for those who are looking for homes in rural or suburban areas.

Jumbo Loan

A jumbo mortgage is used for financing homes that exceed the conforming loan limits set by Fannie Mae and Freddie Mac, usually over $726,000. These loans require excellent credit and strong financials, and allow for the purchase of expensive homes. Jumbo loans are available with competitive rates, but typically require a larger down payment. Jumbo loans are best for buyers living in high-end locations or those purchasing luxury homes.

Summing It Up

Hopefully, this quick guide helps you understand the basics of the different types of loans available. This list is not comprehensive and does not offer complete details on loan qualifications. However, I hope that it answers some of the basic questions home buyers may have. I will be continuing the series on mortgages by going more in depth about individual mortgage types in later articles. I hope you will come back and follow along. And, if you have questions, please feel free to reach out to me, or to a real estate agent in your area.

Resources

https://www.realtor.com/advice/finance/types-of-mortgages/

https://www.forbes.com/advisor/mortgages/types-of-mortgages/

https://www.zillow.com/learn/private-mortgage-insurance/